Lesson 1 Money, its functions and types

Introduction

Task 1 Read the following proverbs about money. Explain their meanings. Remember their Russian equivalents.

· Money makes money.

· Give a thing and get a thing.

· A moneyless man goes fast through the market.

· If you look after the pennies, the dollars will look after themselves.

· He who pays the piper calls the tune.

Task 2 From your point of view, the currency of which country is the most recognizable? Describe it.

Main part

Chapter 1

Vocabulary

double coincidence – двойное совпадение

engage (in) – заниматься чем-либо

efficient – эффективный, результативный

item – здесь: средство, инструмент

· medium of exchange – средство обмена (средство обращения)

eliminate – устранять, уничтожать

· unit of account – единица учёта (мера стоимости)

· store of value – средство накопления или сбережения

purchasing power – покупательская способность

· standard of deferred payment – средство отсроченного платежа

Task 1 Read and translate the following text.

Money is an important feature of virtually every economy. Without money, members of a society must rely on the barter system in order to trade goods and services. Unfortunately, the barter system has an important downside in that it requires a double coincidence of wants - in other words, the two parties engaged in a trade must both want what the other is offering. This feature makes the barter system highly inefficient.

In order to understand much of macroeconomics, it's crucial to have a clear definition of what money is. In general, people tend to use the term "money" as a synonym for "wealth». But these two terms are not synonymous.

In economics, the term money is used specifically to refer to currency, which is, in most cases, not an individual's only source of wealth. In most economies, this currency is in the form of paper bills and metal coins that the government has created, but technically anything can serve as money as long as it possesses four important properties:

· The item serves as a medium of exchange. In order for an item to be considered money, it must be widely accepted as payment for goods and services. In this way, money creates efficiency because it eliminates uncertainty regarding what is going to be accepted as payment by various businesses.

· The item serves as a unit of account. In order for an item to be considered money, it must be the unit that prices, bank balances, etc. are reported in. Having a consistent unit of account creates efficiency since it would be pretty confusing to have the price of bread quoted as a number of fish, the price of fish quoted in terms of t-shirts, and so on.

· The item serves as a store of value. In order for an item to be considered money, it has to (to a reasonable degree) hold its purchasing power over time. This feature of money adds to efficiency because it gives producers and consumers flexibility in the timing of purchases and sales, eliminating the need to immediately trade one's income for goods and services.

· The item serves as a standard for deferred payments. Deferred payments mean those payments which are to be made in the future. If a loan is taken today, it would be paid back after a period of time.

Task 2 Say why the following statements are not right.

1) A double coincidence of wants is a characteristic feature of any trade.

2) Money and wealth are the same things.

3) Not everything can serve as money.

4) Money has three important functions.

5) Money is not efficient as a medium of exchange.

6) Money is not considered to be a unit of account.

7) Money doesn’t serve as a store of value.

8) It is not possible to pay back loans after a period of time.

Task 3 Match the terms to their definitions.

| 1) medium of exchange | a) any form of wealth that maintains its value without depreciating |

| 2) unit of account | b) the accepted way, in a given market, to settle a debt |

| 3) store of value | c) an intermediary instrument used to facilitate the sale, purchase or trade of goods between parties |

| 4) standard of deferred payment | d) something that can be used to value goods and services, record debts, and make calculations |

Task 4 Translate into English.

1) Деньги – особый товар, который выступает в роли эквивалента при обмене экономическими благами.

2) С помощью денег измеряется стоимость товара.

3) Деньги как средство обращения участвуют в покупке и продаже товаров и услуг.

4) Деньги уменьшают издержки и затраты времени для покупки товара и услуги.

5) Деньги как средство платежа используются при выплате заработной платы, при уплате налогов, уплате кредитов и других платежей.

6) Деньги как средство накопления выступают финансовым активом и не участвуют в обороте.

7) Деньги являются удобной формой хранения богатства.

8) Средства накопления обеспечивают владельцу покупательную способность в будущем.

9) Преимущество денег, как средства накопления, заключается в том, что деньги можно немедленно использовать как средство обращения.

Task 5 Put the sentences describing the bar chart in the correct order by numbering them 1-5.

1) From 2000 to 2010 the school increased the money spent on technology from $3,000 to $3,500.

2) We can see that in general the school spent most money on technology.

3) The graph shows how much money Cedar Trees School spent on different facilities from 2000 to 2010.

4) However, not as much money was spent on sport in 2010; the money for sport went down from $2,000 to about $1,500.

5) Also, the money for buildings rose from $2,000 to $3,000.

https://bluelook.net/tips/ielts-Writing/04.html

Homework. Describe the following bar chart.

Chapter 2

Vocabulary

· commodity money – товарные деньги

intrinsic value – собственная стоимость

back – поддерживать, обеспечивать

· fiat money – декретные деньги; без эквивалентные деньги; не разменные деньги

government order – постановление правительства

legal – законный

· fiduciary money – деньги, не обеспеченные золотом; деньги общественного доверия; бумажные деньги в обращении

monetary system – денежная система

token – знак, символ; жетон

· commercial bank money – деньги коммерческих банков

demand deposit – вклад в банк; вклад до востребования

account – счёт

withdraw – снимать со счёта

notice – уведомление

bank draft – банковский чек; тратта

minting – чеканка

· fractional money – разменные деньги

· representative money – представительские деньги (деньги, обеспеченные золотом или серебром)

redeem (for) – выкупать; оплачивать; получать обратно

legal tender – платёжное средство

copper – медь

Task 1 Read and translate the following text.

“Anything can work well as money if it is divisible, portable, acceptable, scarce, durable, and stable”.

There are four different types of money:

· commodity money

· fiat money

· fiduciary money

· commercial bank money

Commodity Money

It is the simplest kind of money which is used in barter system where the valuable resources fulfill the functions of money. The value of this kind of money comes from the value of resource used for the purpose. It is only limited by the scarcity of the resources. Value of this kind of money involves the parties associated with the exchange process. This money has intrinsic value.

Whenever any commodity is used for the exchange purpose, the commodity becomes equivalent to the money and is called commodity money. There are certain types of commodity, which are used as the commodity money. For example: gold coins, beads (бисер), shells, pearls, stones, tea, sugar, and metal.

Fiat Money

The word fiat means the “command of the sovereign”. Fiat currency is the kind of money which doesn’t have any intrinsic value and it can’t be converted into valuable resource. The value of fiat money is determined by government order which makes it a legal instrument for all transaction purposes. The fiat money need to be controlled as it may affect entire economy of a country if it is misused. Today fiat money is the basis of all the modern money system. The real value of fiat money is determined by the market forces of demand and supply. The example is paper money, coins.

Fiduciary Money

Today’s monetary system is highly fiduciary. Whenever, any bank assures the customers to pay in different types of money and when the customer can sell the promise or transfer it to somebody else, it is called the fiduciary money. Fiduciary money is generally paid in gold, silver or paper money. There are cheques and bank notes, which are the examples of fiduciary money because both are some kind of token which are used as money and carry the same value.

Commercial Bank Money

Commercial Bank money or demand deposits are claims against financial institutions that can be used for the purchase of goods and services. A demand deposit account is an account from which funds can be withdrawn at any time by cheque or cash withdrawal without giving the bank or financial institution any prior notice. Banks have the legal obligation to return funds held in demand deposits immediately upon demand (or ‘at call’). Demand deposit withdrawals can be performed in person, via cheques or bank drafts, using automatic teller machines (ATMs), or through online banking.

There are also various other types of money like the credit money, electronic money, coin and paper money, fractional money and representative money.

Fractional Money

It is a hybrid type of money which is partly backed by a commodity and has a fiat money transaction purpose. If the commodity loses its value then fractional money converts into fiat money.

Representative money

It represents a claim on commodity and it can be redeemed for that commodity at a bank. It is a token or paper money that can be exchanged for a fixed quantity of commodity. Its value depends on the commodity it backs.

Coins

Metals of particular weight are stamped into coins. There are various precious metals like gold, silver, bronze, copper whose coins are already used in human history. The minting of coins is controlled by the state.

Paper money

Paper money doesn’t have any intrinsic value, as a fiat money it is approved by government order to be treated as legal tender through which value exchange can happen. Governments print the paper money according to the requirements which is tightly controlled as it can affect the economy of the country.

Interesting facts about various types of money:

• In China cowrie shells (каури; раковины) were regarded as money during 1000 B.C to 1200 B.C.

• Leather bags were treated as money in the ancient city of Carthage /ˈkɑːrθɪdʒ/.

• Copper coins are treated as money by Romans 600B.C.

• Silver coins were treated as money by Ancient Persians between 600-300 B.C.

• Gold coins were treated as money in 600 B.C. in Anatolia (Asian Turkey or Asia Minor)

• Paper money first appeared in China about 800 AD. In Europe, Sweden is the first country to issue paper money in 1661.

https://finance.mapsofworld.com/money/types/

Task 2 Fill in the gaps with one of the vocabulary terms.

1) _____ is money whose value comes from a commodity of which it is made.

2) _____ is currency that a government has declared to be legal tender.

3) _____ is a set of mechanisms by which a government provides money (cash) in a country's economy.

4) _____ is currency in denominations less than the basic monetary unit.

5) _____ is an item such as a token or piece of paper that has no intrinsic value but can be exchanged on demand for a commodity that does have intrinsic value, such as gold, silver, copper, and even tobacco.

6) _____ is currency in paper form, such as government and bank notes, as distinguished from metal currency.

Task 3 Answer the questions.

1) What types of money are printed by the government?

2) What does money value depend on?

3) Does commercial bank money equal demand deposits?

4) Why must banks return funds held on demand deposits immediately upon demand?

5) What type of money is the basis of all the money systems?

6) What is the disadvantage of commodity money?

Task 4 Write a persuasive argument for why a civilization should not choose dried peas as its money.

Task 4 Translate into English.

Фиатные деньги - известны также как декретные деньги - валюта, которую правительство объявило в качестве законного средства платежа, несмотря на то, что она не имеет никакой внутренней стоимости и не обеспечена резервами. Исторически, большинство валют было основано на обеспечении физическим товаром, таким как золото или серебро, но фиатные деньги обеспечиваются исключительно доверием к государству.

Сегодня большая часть бумажных денег в мире является фиатными деньгами. Поскольку фиатные деньги не привязаны к физическому обеспечению или валютным резервам, они всегда подвержены риску обесценивания вследствие гиперинфляции. Если люди потеряют веру в национальные бумажные деньги, то деньги больше не будут обладать никакой стоимостью.

Task 6 Read and translate the text about a pie chart.

A pie chart (or a circle chart) is a circular statistical graph which is divided into slices to illustrate numerical proportion. In a pie chart, the arc length of each slice (and consequently its central angle and area), is proportional to the quantity it represents.

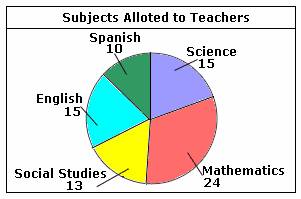

The pie chart shown above represents the number of teachers for different subjects in a school.

The number at each pie slice indicates the number of teachers allotted for the particular subject.

As the pie chart shows, the number of teachers allotted for Mathematics is 24; the number of teachers allotted for Social Studies is 13; the number of teachers allotted for English is 15; the number of teachers allotted for Spanish is 10; and the number of teachers allotted for Science is 15.

Task 7 The pie chart shown below represents the percentage of dams built for different purposes. Find the total percentage of dams built for irrigation and hydroelectricity generation.

Choices:

A. 56% B. 38% C. 40% D. 45%

Lesson 3 Money supply, inflation and its types

Introductory activity

Task 1 Read and translate these word combinations.

Money supply, inflation crisis, price-level inflation, inflation rate, percentage change, price index, labour market.

Main activity

Vocabulary

home equity – собственный капитал домовладельца

assets – имущество, фонды, активы

mortgage – ипотека, заклад

purchasing power – покупательная способность

annual – ежегодный

measure – мера; единица измерения

Consumer Price Index – индекс потребительских цен

severity – тяжесть; трудность

liquidity trap – ликвидная ловушка (нечувствительность нормы процента к изменениям денежной массы)

monetary authorities – финансовые органы

interest rate – процентная ставка

persist – оставаться; удерживаться

outrageous – чрезмерный

creeping inflation – ползучая инфляция

hyperinflation – гиперинфляция

demand-pull inflation – инфляция

cost-push inflation – инфляция издержек

Task 1 Read and translate the following text.

The money supply is physical cash in circulation plus the money held in checking and savings accounts.

It does not include other forms of wealth, such as investments, home equity, or assets. They must be sold to convert them to cash. It also does not include credit, such as loans, mortgages and credit cards. People use these as money to improve their standard of living, but they aren't part of the money supply.

Money supply was once related to inflation. Inflation indicates to a rise in prices that causes the purchasing power of a nation to fall. Inflation is a normal economic development as long as the annual percentage remains low; once the percentage rises over a pre-determined level, it is considered an inflation crisis. A chief measure of general price-level inflation is the general inflation rate, which is the percentage change in a general price index, normally the Consumer Price Index, over time. Inflation can cause negative effects on the economy. For example, uncertainty about future inflation may discourage investment and saving.

High inflation may lead to shortages of goods if consumers begin hoarding out of concern that prices will increase in the future.

Low (as opposed to zero or negative) inflation may reduce the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reducing the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control the size of the money supply through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.

The most common types of inflation are creeping inflation, chronic inflation, and hyperinflation.