| год | значение |

| 3.4 | |

| 4.2 | |

| 5.6 | |

| 4.6 | |

| 6.2 | |

| 8.6 | |

| 9.9 | |

| 11.1 | |

| 11.7 | |

| 12.4 |

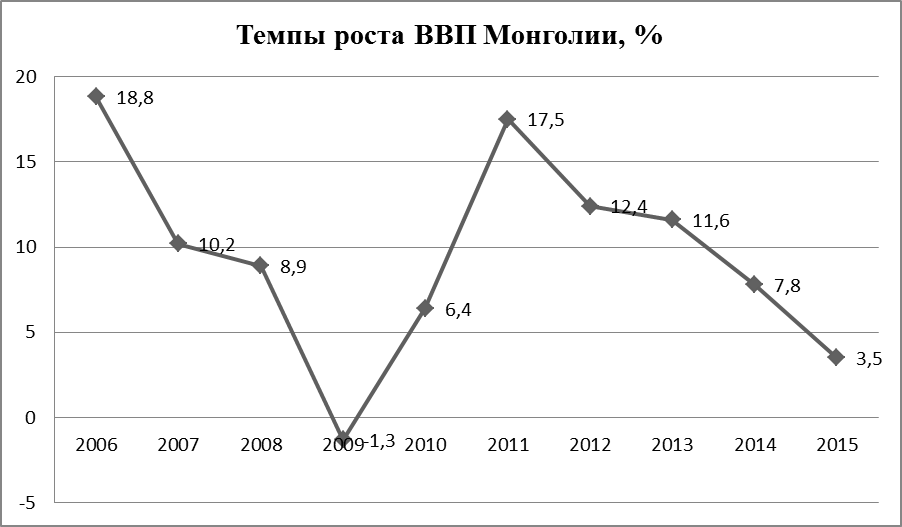

Темпы роста ВВП Монголии, %

| год | значение |

| 18.8 | |

| 10.2 | |

| 8.9 | |

| -1.3 | |

| 6.4 | |

| 17.5 | |

| 12.4 | |

| 11.6 | |

| 7.8 | |

| 3.5 |

Темпы роста ВВП Вьетнама, %

| год | значение |

| 8.2 | |

| 8.5 | |

| 6.3 | |

| 5.3 | |

| 6.8 | |

| 6.2 | |

| 5.2 | |

| 5.4 | |

| 6.0 | |

| 6.5 | |

B Ai0AFAAGAAgAAAAhAD4olHj1AAAA1gEAACAAAAAAAAAAAAAAAAAAmgYAAGRycy9jaGFydHMvX3Jl bHMvY2hhcnQxLnhtbC5yZWxzUEsBAi0AFAAGAAgAAAAhAIOqMinfAAAABQEAAA8AAAAAAAAAAAAA AAAAzQcAAGRycy9kb3ducmV2LnhtbFBLAQItABQABgAIAAAAIQAS+1ytxAMAABQJAAAVAAAAAAAA AAAAAAAAANkIAABkcnMvY2hhcnRzL2NoYXJ0MS54bWxQSwECLQAKAAAAAAAAACEAPkGM6X0jAAB9 IwAALgAAAAAAAAAAAAAAAADQDAAAZHJzL2VtYmVkZGluZ3MvTWljcm9zb2Z0X0V4Y2VsX1dvcmtz aGVldDEueGxzeFBLBQYAAAAACQAJAG4CAACZMAAAAAA= ">

B Ai0AFAAGAAgAAAAhAD4olHj1AAAA1gEAACAAAAAAAAAAAAAAAAAAmgYAAGRycy9jaGFydHMvX3Jl bHMvY2hhcnQxLnhtbC5yZWxzUEsBAi0AFAAGAAgAAAAhAIOqMinfAAAABQEAAA8AAAAAAAAAAAAA AAAAzQcAAGRycy9kb3ducmV2LnhtbFBLAQItABQABgAIAAAAIQAS+1ytxAMAABQJAAAVAAAAAAAA AAAAAAAAANkIAABkcnMvY2hhcnRzL2NoYXJ0MS54bWxQSwECLQAKAAAAAAAAACEAPkGM6X0jAAB9 IwAALgAAAAAAAAAAAAAAAADQDAAAZHJzL2VtYmVkZGluZ3MvTWljcm9zb2Z0X0V4Y2VsX1dvcmtz aGVldDEueGxzeFBLBQYAAAAACQAJAG4CAACZMAAAAAA= ">

| $343,980,000 | |

| $372,754,400 | |

| $844,697,900 | |

| $623,609,200 | |

| $1,692,184,000 | |

| $4,712,849,000 | |

| $4,451,762,000 | |

| $2,150,897,000 | |

| $383,931,300 | |

| $2,400,000,000 | |

| $6,700,000,000 | |

| $9,579,000,000 | |

| $7,600,000,000 | |

| $8,000,000,000 | |

| $7,430,000,000 | |

| $8,368,000,000 | |

| $8,900,000,000 | |

| $9,200,000,000 |

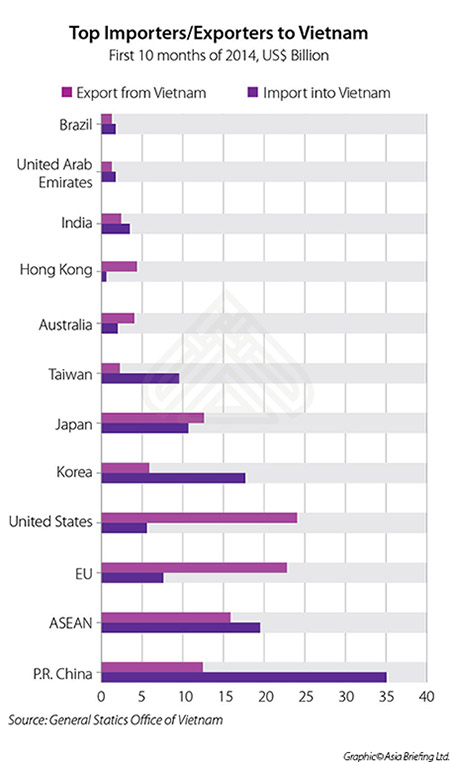

Introduction to Vietnam’s Import & Export Industries

Posted on February 3, 2015 by Vietnam Briefing

By Dam Thi Phuong Mai and Edward Barbour-Lacey

HCMC – With its rising costs, China is no longer the go to destination for many businesses, and Vietnam has arisen as a serious competitor. Recent trends show that the number of orders shifting from China to Vietnam has seen a significant increase. For example, China’s Pearl River Delta, long known as one of the key factory centers for the world’s manufacturers (particularly those from Hong Kong) has now become too costly for many companies to stay in the region.

In the past three years alone, a growing number of businesses have relocated their operations from China to Vietnam in an attempt to escape rising costs and an increasingly complex regulatory environment. Located in a strategic position for foreign companies with operations throughout Southeast Asia, Vietnam is an ideal export hub to reach other ASEAN markets.

RELATED: Dezan Shira & Associates’ Business Advisory Services

Compared with other developing markets in the region, Vietnam is emerging as the clear leader in low-cost manufacturing and sourcing, with the country’s manufacturing sector now accounting for 25 percent of Vietnam’s total GDP. Currently, labor costs in Vietnam are 50 percent of those in China and around 40 percent of those reported in Thailand and the Philippines. With the country’s workforce growing annually by around 1.5 million, Vietnamese workers are inexpensive, young, and, increasingly, highly skilled.

Another driving force behind Vietnam’s growing popularity is the country’s collection of free trade agreements (FTAs)—most notably, the soon-to-be-signed Trans-Pacific Partnership (TPP) and EU-Vietnam FTA. Additional FTAs currently under negotiation include the Regional Comprehensive Economic Partnership (RCEP) and the ASEAN Economic Community (AEC). When these trade agreements come into force, Vietnamese exports will be freely accessible to many of the world’s largest markets with few tariffs or restrictions.

In terms of regulatory and financial incentives, Vietnam has become increasingly investor-friendly in recent years –the government has taken such actions as reforming its financial sector, streamlining business regulations, and improving the quality of its workforce. Since the mid-2000s, the Vietnamese government has offered extremely competitive financial incentives to businesses seeking to set up operations in the country, in addition to a zero percent withholding tax on dividends remitted overseas and a low corporate income tax (CIT) rate of only 22 percent (set to drop to 20 percent in 2016). These advantages have enabled Vietnam to become a premier “sourcing economy” in the eyes of many companies.

For a consultation on Vietnam’s Export and Import Procedures on specific products, please contact Dezan Shira & Associates at vietnam@dezshira.com

The current state of Vietnam’s economy

Vietnam is seeing strong growth on multiple fronts. Of particular interest to investors has been the continuing growth of Vietnam’s domestic consumer market, which has been developing by leaps and bounds. This growth is expected to continue for some time to come – domestic consumption is predicted to increase at a rate of 20 percent per year. With a population of over 90 million and Southeast Asia’s fastest growing middle class, Vietnam clearly represents an important market for foreign goods. Following along with this trend, in November, consumer confidence levels in Vietnam exceeded 100 points for the first time since 2012.

Industry Snapshots

While Vietnam is widely known for being a prime location for investors operating in the textile industry, there are many other business areas that are seeing significant growth in the country. Interestingly, Vietnam is well on its way to becoming a key location for high-technology manufacturing, with companies like Samsung, LG Electronics, Nokia, and Intel making multi-billion dollar investments into the country. Other business areas include information and communications technology, automotive, and medical devices.

The American Chamber of Commerce predicts that Vietnam will become the largest ASEAN supplier to the U.S. by the end of 2014 – with a net export value of around US$29.4 billion. In fact, Vietnam is likely to become the wealthiest Southeast Asian country in terms of trade. Additional statistics indicate that bilateral trade with the U.S. will surge to US$57 billion by 2020, cementing Vietnam’s prominence as a valuable hub for foreign investment.

Textiles and Garments

Textiles consistently rank among Vietnam’s leading export industries, employing upwards of 1.3 million workers in directly related jobs and more than two million with auxiliary work included. The growth of the garment industry has been impressive. AmCham states that Vietnamese garment exports rose by 14.85 percent in October alone. China is the only nation that surpasses Vietnam in terms of net garment exports to the U.S.. However, manufacturers and investors are pivoting towards Vietnam; the conditions for setting up shop are economical and more convenient than doing so in China.

Within ASEAN, Vietnam is the strongest competitor for inheriting low value-added textiles and apparel manufacturing from China. In contrast to other leading textile exporters in the region (Indonesia, Thailand, Malaysia), the share of Vietnam’s textile exports against its total exports has grown in recent years.

In terms of revenue, footwear is Vietnam’s third most productive export industry, generating US$8.5 billion in 2013. The country produces 800 million pairs of shoes per year.

Electronics

Vietnam has emerged as an important electronics exporter, with electrical and electronic products overtaking coffee, textiles, and rice to become the country’s top export item. Samsung is Vietnam’s largest exporter and has helped the country achieve a trade surplus for the first time in many years. Exports of smartphones and computer parts now account for more in export earnings than oil and garments. Samsung is attempting to turn Vietnam into a global manufacturing base for its products and has invested over US$10 billion into the country.

Samsung has also agreed to cooperate with the Vietnamese government in order to help develop the country’s domestic support industries. This represents a key business opportunity for foreign technology companies to set up operations in Vietnam and sell their components to companies like Samsung.

On July 29, 2014, Intel announced that it had produced its first made-in-Vietnam CPU. By the end of this year, Intel expects to manufacture 80 percent of their CPUs for the world market in Vietnam.

Pharmaceuticals

The future looks to be very interesting for the pharmaceutical industry in Vietnam. Recent economic forecasts have predicted a US$5 billion increase in value over the next six years, reaching a net worth of US$8 billion by 2020 – a compound annual growth rate (CAGR) of 15.4 percent. Driving this market growth is the Vietnamese government’s goal of achieving universal health coverage by 2015. Thirty percent of the country’s population still has no form of public health insurance.

Automotive

Vietnam is becoming an important market for auto sales – August was the 17th consecutive month of sales growth, with a 59 percent year on year increase and total sales of 12,562 units. Overall sales for 2014 are now forecast to be 130,000 units, representing an 18 percent growth year on year. Sales for the eight-month period saw a 32 percent increase compared with 2013. Interestingly, despite the country’s recent economic struggles, the luxury car market has continued to see healthy growth.

Despite an increasingly competitive auto market throughout the ASEAN region, Vietnam has stated that it intends to work aggressively to build up its own domestic auto industry. Among the key reasons for this goal is that the auto industry has the potential to create thousands of jobs for locals and create a strong system of supporting industries.

Coffee

Vietnam is poised to become the world’s largest producer and exporter of coffee. Currently, the country is the world’s second largest coffee exporter, behind only Brazil. However, many experts believe that Vietnam has the potential to overtake Brazil thanks to such factors as favorable climate conditions and lower cost production. In recent years, coffee has become one of Vietnam’s key agricultural export products – with 95 percent of output being shipped abroad.

E-commerce

Vietnam is quickly becoming a prime market for foreign investment in e-commerce activities. The country’s rapidly growing economy and middle class are, in turn, spawning a strong consumer culture and increasing levels of disposable income. Electronic retail is fast becoming the preferred method of shopping—particularly among the country’s youth. It is predicted that in 2015 Vietnam will see more than US$4 billion in B2C e-commerce sales – current sales are estimated at around US$2.2 billion, with an average spending of US$120 per capita.

By 2016, internet penetration in Vietnam will reach 43 million people – 40-45 percent of the total population. This percentage is thought to be the “golden proportion” at which investors will pour into the e-commerce market.

Более того, американские и британские эксперты бьют тревогу, говоря, что Монголия, не имеющая выхода к морю, может попасть в более серьезную, чем раньше, зависимость от России и Китая, дав добро на постройку железных дорог к российским портам.

Как известно, 50% акций железных дорог Монголии принадлежат России. Однако это не является гарантией того, что Китай не вытеснит Россию. Так, Всемирный банк реконструкции и развития уже раскритиковал монгольские планы строительства железных дорог к российским портам, отмечая, что транспортировка по более протяженному и неустроенному российскому маршруту обойдется в три раза дороже, чем отправка грузов в более ближние порты северного Китая.