UNIT 5 FINANCIAL REPORTING

GETTING STARTED

Discuss the following questions with your partners:

● Why is the end of financial year an extremely busy time for accountants?

● In what forms do accountants present information about a company’s financial performance to the people interested in it?

Compare your findings with the information given below.

Financial statements are important reports. They show how a business is doing and are very useful internally for a company's stockholders and to its board of directors, its managers and some employees, including labor unions. Externally, they are important to prospective investors, to government agencies responsible for taxing and regulating, to lenders such as banks and credit rating agencies, and to investment analysts and stockbrokers.

All public companies are required to prepare documents showing the company's financial performance at regular periodic intervals. Most companies prepare annual statements; others prepare them semiannually, quarterly or as often as monthly. These show the financial wealth of a company (how much it owes and owns) but can be manipulated. It is often required that statements for external consumption be audited by independent accounting firms.

Financial Statements by Veronica Romualdez, eHow Contributor

USEFUL VOCABULARY

Make sure you know the following words and word combinations.

| financial reporting | финансовая (бухгалтерская) отчетность |

| financial statement = financial report (or financial account British English) | финансовый (бухгалтерский) отчет |

| financial position | финансовоe положение (состояние) |

| balance sheet | бухгалтерский баланс |

| income statement (= profit and loss statement = P&L) | отчет о прибылях и убытках |

| statement of cash flows | отчет о движении денежных средств |

| notes (to financial statements) n | пояснительная записка (к годовому отчету) |

| accounts receivable | счета дебиторов, дебиторская задолженность |

| accounts payable | кредиторская задолженность |

| takeover n | присоединение, поглощение |

| asset (often pl) n | актив; имущество, средства, ресурсы |

| (in)tangible assets | (не)осязаемые/(не)материальные активы |

| (non)current assets | (вне)оборотные активы |

| fixed assets | долгосрочные (внеоборотные) активы |

| liability n( =obligation) | обязательство, пассив |

| pay off v ( = repay) | рассчитываться, расплачиваться |

| inventory (often pl) n (US) =stock (UK) | (материально-производственные) запасы |

| solvency n | платёжеспособность; кредитоспособность |

| goodwill n | деловая репутация фирмы, гудвил |

| entry n | статья (отчетности) |

| viability n | жизнеспособность; экономическая целесообразность |

| ascertain v | устанавливать; определять, убеждаться; выяснять, узнавать |

| cash on/in hand | кассовая наличность |

READING

Text 1

1. Read the text and draw up an outline of it; make use of the items given below and rearrange them in the proper order.

- Types of financial statements

- International financial reporting standards

- Purposes of financial statements

- Moving to electronic financial statements

- Definition of financial statements

-

Financial Statements

Financial statements are the product of the financial accounting process. A financial statement (or financial report) is a formal record of the financial activities of a business, person, or other entity. For a business enterprise, the financial statements present all the relevant financial information in a structured manner and in a form easy to understand. They typically include four basic financial statements:

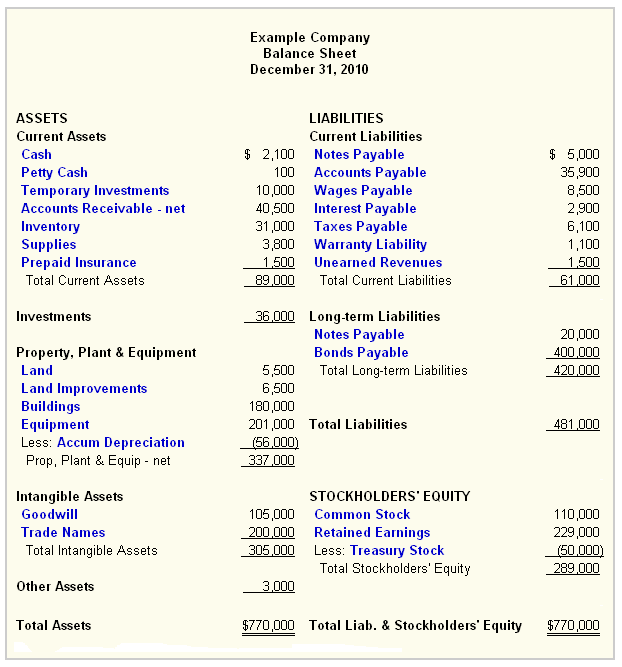

Balance sheet, also referred to as statement of financial position or condition, reports on a company's assets, liabilities, and ownership equity at a given point in time.

Income statement, also referred to as Profit and Loss statement (or a "P&L"), reports on a company's income, expenses, and profits over a period of time. Profit & Loss accounts provide information on the operation of the enterprise. These include sale and the various expenses incurred during the processing state.

Statement of retained earnings explains the changes in a company's retained earnings over the reporting period.

Statement of cash flows reports on a company's cash flow activities, particularly its operating, investing and financing activities.

For large corporations, these statements are often complex and may include an extensive set of notes to the financial statements and management discussion and analysis. The notes are considered an integral part of the financial statements, and typically describe each item on the statement in further detail.

The objective of financial statements is to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions. Financial statements should be understandable, relevant, reliable and comparable. Reported assets, liabilities, equity, income and expenses are directly related to an organization's financial position.

Financial statements may be used for different purposes:

● owners and managers require financial statements to make important business decisions that affect a company’s continued operations; these statements are also used as part of management's annual report to the stockholders;

● employees need these reports in making collective bargaining agreements with the management, in the case of labor unions or for individuals in discussing their compensation, promotion and rankings;

● prospective investors make use of financial statements to assess the viability of investing in a business;

● financial institutions (banks and other lending companies) use them to decide whether to grant a company with fresh working capital or extend debt securities (such as a long-term bank loan) to finance expansion and other significant expenditures;

● government entities (tax authorities) need financial statements to ascertain the propriety and accuracy of taxes and other duties declared and paid by a company;

● vendors who extend credit to a business require financial statements to assess the creditworthiness of the business;

● media and the general public are also interested in financial statements for a variety of reasons.

Financial statements have been created on paper for hundreds of years. The growth of the Web has seen more and more financial statements created in an electronic form which is exchangeable over the Web. Common forms of electronic financial statements are PDF and HTML. These types of electronic financial statements have their drawbacks in that it still takes a human to read the information in order to reuse the information contained in a financial statement.

More recently a market driven global standard, XBRL (eXtensible Business Reporting Language1), which can be used for creating financial statements in a structured and computer readable format, has become more popular as a format for creating financial statements. Many regulators around the world have mandated XBRL1 for the submission of financial information.

Standards and regulations

Different countries have developed their own accounting principles over time, making international comparisons of companies difficult. To ensure uniformity and comparability between financial statements prepared by different companies, a set of guidelines and rules are used. Commonly referred to as Generally Accepted Accounting Principles (GAAP), these sets of guidelines provide the basis in the preparation of financial statements.

Recently there has been a push towards standardizing accounting rules made by the International Accounting Standards Board ("IASB"). IASB develops International Financial Reporting Standards that have been adopted by Australia, Canada and the European Union (for publicly quoted companies only), are under consideration in South Africa and other countries. The United States Financial Accounting Standards Board has made a commitment to converge the U.S. GAAP and IFRS over time.

Notes

1 XBRL (eXtensible Business Reporting Language – ”расширяемый язык деловой отчетности» — открытый стандарт для представления финансовой отчетности в электронном виде

2. Write at least 6 questions to ask your partner about most essential details of financial statements mentioned in the text.

Text 2

1. Read the text and explain why the balance sheet is called a snapshot of the organization’s financial position.

The Balance Sheet

The Balance sheet is a listing of the organization’s resources (assets), obligations (liabilities), and owner’s claims (equity) at a point in time. In this sense, the balance sheet is like a snapshot of the organization’s financial position, frozen at a specific point in time.

Assets are resources that a company owns that have value. This typically means they can either be sold or used by the company to make products or provide services that can be sold. Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Typical current assets include cash, cash equivalents, short-term investments, accounts receivable, inventory and the portion of prepaid liabilities which will be paid within a year. Noncurrent assets include fixed assets that are used to operate the business but not available for sale, such as plants, trucks, equipment, and office furniture.

Assets are frequently tangible – they can be seen or handled (e.g., cash, merchandise inventory, or equipment), or evidence of their existence can be observed (e.g. accounts receivable). Intangible assets include goodwill, patents, copyrights, trademarks, franchises, and similar valuable but nonphysical things controlled by the business.

Liabilities are amounts of money that a company owes to others. This can include all kinds of obligations, like money borrowed from a bank to launch a new product, rent for use of a building, money owed to suppliers for materials, payroll a company owes to its employees, environmental cleanup costs, or taxes owed to the government. Liabilities also include obligations to provide goods or services to customers in the future.

Liabilities are generally listed based on their due dates. Liabilities are said to be either current or long-term. Current liabilities are obligations a company expects to pay off within the year. Long-term liabilities are obligations due more than one year away.

Owners’ equity is sometimes referred to as net assets, or net worth. It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners, of the company. The owners’ equity section of a corporation is called stockholders’ equity and has two parts: contributed and earned capital, or retained earnings.

The following equation summarizes what a balance sheet shows:

ASSETS = LIABILITIES + OWNERS' EQUITY

A company's assets have to equal, or "balance," the sum of its liabilities and shareholders' equity.

A company’s balance sheet is set up like the basic accounting equation shown above. On the left side of the balance sheet, companies list their assets. On the right side, they list their liabilities and shareholders’ equity. Sometimes balance sheets show assets at the top, followed by liabilities, with shareholders’ equity at the bottom.

2. Say if the following statements are true or false.

1) The balance sheet is often compared with a moving picture of the organization’s financial performance.

2) Noncurrent assets are fixed assets available for sale.

3) Tangible assets include goodwill, patents, copyrights, trademarks, etc.

4) Money owed to suppliers is listed under liabilities.

5) Obligations that a company expects to pay off within a year are long-term liabilities.

6) On the balance sheet company’s assets have to equal liabilities plus owner’s equity.

7) Net worth is the money left if the company sells all its assets and paid all its liabilities.

3. Answer the following questions.

1) What comparison is commonly used to describe the meaning of the balance sheet?

2) How are assets classified?

3) What is the difference between current and noncurrent assets?

4) What current assets are shown on the sample balance sheet given?

5) What does the word intangible mean and why is it used as a term to denote such assets as goodwill and copyrights?

6) In what order are liabilities listed?

7) What long-term liabilities are represented on the example balance sheet?

8) What is owner’s equity?

9) What has to be “balanced” on a company’s balance sheet?

10) What are the possible varieties of arranging data on the balance sheet?

Text 3

The Income Statement

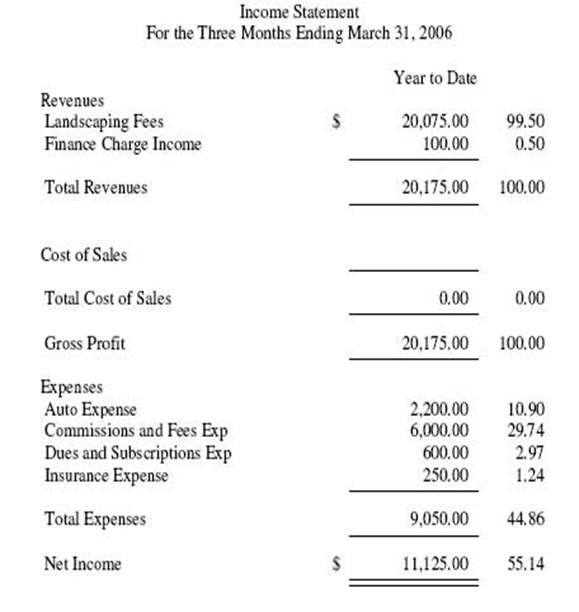

Read the text explaining how Income Statements are organized, while reading look at the sample income statement illustrating the description; respond to the question put at the end of the reading.

An income statement is a report that shows how much revenue a company earned over a specific time period (usually for a year or some portion of a year). An income statement also shows the costs and expenses associated with earning that revenue. The literal “bottom line” of the statement usually shows the company’s net earnings or losses. This tells you how much the company earned or lost over the period.

Income statements also report earnings per share (or “EPS”). This calculation tells you how much money shareholders would receive if the company decided to distribute all of the net earnings for the period. (Companies almost never distribute all of their earnings. Usually they reinvest them in the business.)

To understand how income statements are set up, think of them as a set of stairs. You start at the top with the total amount of sales made during the accounting period. Then you go down, one step at a time. At each step, you make a deduction for certain costs or other operating expenses associated with earning the revenue. At the bottom of the stairs, after deducting all of the expenses, you learn how much the company actually earned or lost during the accounting period. People often call this “the bottom line.”

At the top of the income statement is the total amount of money brought in from sales of products or services. This top line is often referred to as gross revenues or sales. It’s called “gross” because expenses have not been deducted from it yet. The next line is money the company doesn’t expect to collect on certain sales. This could be due, for example, to sales discounts or merchandise returns.

When you subtract the returns and allowances from the gross revenues, you arrive at the company’s net revenues. It’s called “net” because, if you can imagine a net, these revenues are left in the net after the deductions for returns and allowances have come out.

Moving down the stairs from the net revenue line, there are several lines that represent various kinds of operating expenses. Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales. This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period.

The next line subtracts the costs of sales from the net revenues to arrive at a subtotal called “gross profit” or sometimes “gross margin.” It’s considered “gross” because there are certain expenses that haven’t been deducted from it yet.

The next section deals with operating expenses. These are expenses that go toward supporting a company’s operations for a given period – for example, salaries of administrative personnel and costs of researching new products. Marketing expenses are another example. Operating expenses are different from “costs of sales,” which were deducted above, because operating expenses cannot be linked directly to the production of the products or services being sold.

Depreciation is also deducted from gross profit. Depreciation takes into account the wear and tear on some assets, such as machinery, tools and furniture, which are used over the long term.

After all operating expenses are deducted from gross profit, you arrive at operating profit before interest and income tax expenses. This is often called “income from operations.”

Finally, income tax is deducted and you arrive at the bottom line: net profit or net losses. (Net profit is also called net income or net earnings.) This tells you how much the company actually earned or lost during the accounting period. Did the company make a profit or did it lose money?

DEVELOPING VOCABULARY

1. Complete the sentences by forming adjectives from the verbs in brackets according to the given pattern; think of the Russian equivalents of the derivatives obtained:

v + -able ® adj 'that can be v-ed', e.g.

measure + -able ® measurable 'that can be measured' – 1) поддающийся измерению, измеримый; 2) умеренный, небольшой

1) …… income is the amount of your income on which you pay taxes (tax).

2) There has been an …… drop in the number of unemployed since the new government came to power (appreciate).

3) It’s claimed that they produce the best cars in the world but I think it’s …… (dispute).

4) The trade unions have described the latest pay offer as un …… (accept).

5) Europe could become a unit as economically in ……. as America’s united states (divide).

6) These forgeries are so good that they are more or less in …….. from the originals (distinguish).

7) There has been a …… improvement in company’s performance (notice).

8) Scientists often work with phenomena that are not directly …… (observe).

9) In households, accounts ……. are ordinarily bills from the electric company, telephone company, or cable television and other such regular services (pay).

10) Accounts …… is the amount of money that is owed to the company after the company extends the customer credit (receive).

11) As director, she knew she would be ……. for any budget deficit (account).

12) This part of the law is only ……. to companies employing more than five people (apply).

13) Some economists think that full employment in Europe is an un……. goal (attain).

2. Complete the ‘spidergram’ supplying nouns that can take financial as an attribute.

statement

decisions accounting

decisions accounting

financial

|  | ||||||||

|  | ||||||||

| |||||||||

3. Identify accounting terms defined on the left, some prompts are given.

| 1) the company that has supplied goods but has not received any money for them yet | c_ _ _ _ _ _ r |

| 2) in the USA, the products or supplies of an organization on hand or in transit at any time, e.g. raw material or finished goods | i_ _ _ _ _ _ _ y |

| 3) the good reputation and good relationships that a company has with its customers, and how much these are worth if the company is sold. | g_ _ _ _ _ _ l |

| 4) the movements of cash in and out of business | c_ _ _ f_ _ _ |

| 5) something such as money or property that a person or company owns | a_ _ _ _ s |

| 6) the last line of a financial statement that shows the net profit or loss of a company or organization | b_ _ _ _ _ l_ _ _ |

| 7) customers who have received goods but not paid for them yet | d_ _ _ _ r |

| 8) the amounts owed by a business to suppliers (e.g. for raw materials) | a_ _ _ _ _ _ s p _ _ _ _ _ _ |

| 9) an obligation to transfer money as a result of past transactions | l_ _ _ _ _ _ _ y |

| 10)A record made in a book of account, register, or computer file of a financial transaction, event, proceeding | e_ _ _ y |

| 11) a situation in which you have enough money to pay your bills and other debts | s_ _ _ _ _ _ y |

4. Complete the sentences with suitable collocations from the list, make the necessary form adjustments:

take losses tangible assets run at a loss generate revenue bottom line